Improving Social Security Policies to Enhance Work Incentives for the Working Poor – South Korea Institute of Public Finance

Korea has various social security programs, such as unemployment benefits, basic living allowances, and the National Employment Support System, aimed at assisting low-income groups. These government welfare policies help individuals who are unemployed, either voluntarily or involuntarily, or have low incomes, guiding them back into the labor market. However, how effective are these policies in practice? To explore this, the Korea Institute of Public Finance has published a report titled "Improving Social Security Policies to Enhance Work Incentives for the Working Poor."

This report aims to develop improvements in social security policies to ensure the working poor can sustain economic activities. It evaluates existing social security programs and seeks ways to strengthen inter-policy alignment to enhance work incentives. A key focus is resolving conflicts between basic living allowances and the Earned Income Tax Credit (EITC).

1. Overview of Social Security Policies

Korea operates several social security programs, including basic living allowances, the EITC, unemployment benefits, and the National Employment Support System. However, since these programs operate independently rather than complementing each other, they often reduce actual work incentives.

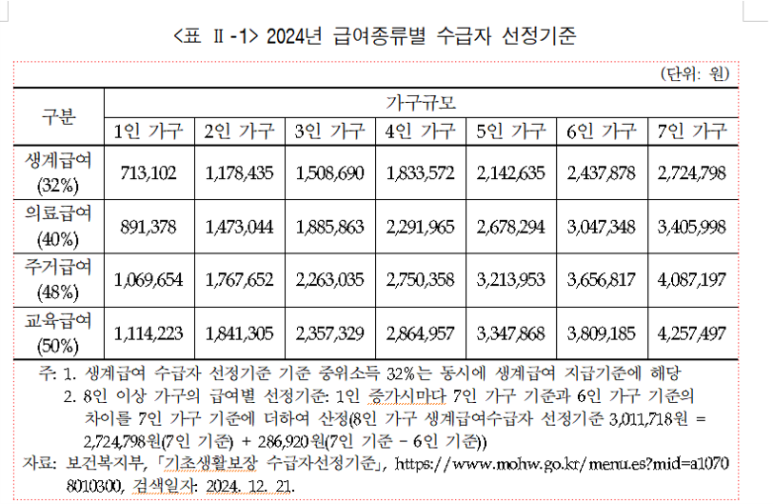

✔ Basic Living Allowance – Provides financial support for basic living needs, but when employment income increases, the benefits decrease sharply, potentially discouraging work.

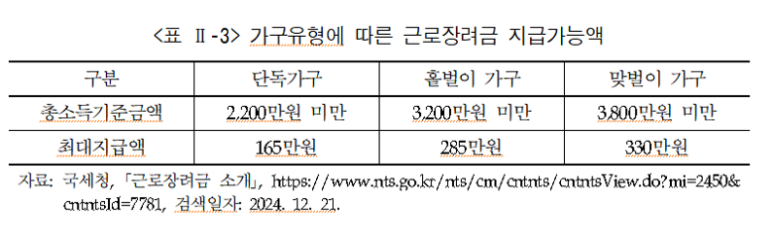

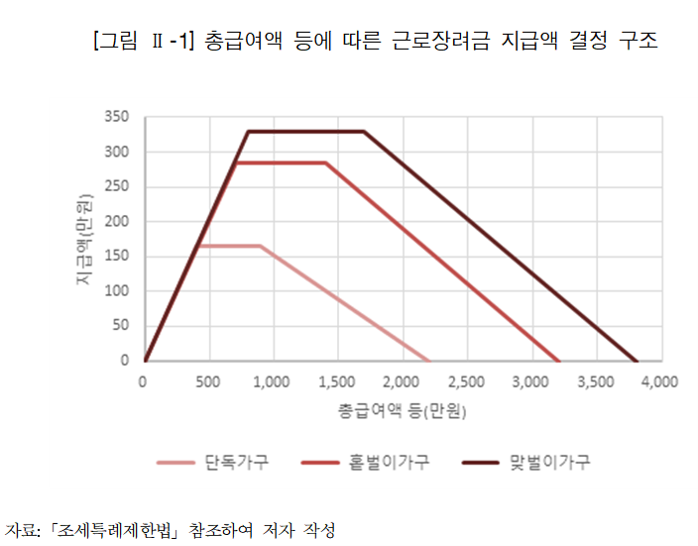

✔ Earned Income Tax Credit (EITC) – Provides refundable tax credits based on earned income, business income, and religious income. It aims to encourage low-income workers to stay in the labor market, but the declining benefit structure may discourage workers from increasing their income. The graphs below illustrate how EITC gradually decreases for single households earning over KRW 9 million, single-earner households earning over KRW 14 million, and dual-earner households earning over KRW 17 million annually. Once income exceeds a certain threshold, EITC benefits decrease, which could weaken work incentives.

✔ Unemployment Benefits – Individuals insured under employment insurance can receive benefits if they leave their jobs involuntarily due to dismissal, business closures, or contract expiration. While it provides short-term economic stability, it does not always lead to long-term reemployment.

✔ National Employment Support System – Provides job support services and additional income support for low-income job seekers.

2. Global Case Studies: Different Approaches to Social Security

Social security policies vary by country due to differences in economic structures, labor market conditions, and societal values. This section examines cases from the UK, the US, Germany, France, and Sweden, providing insights for Korea's policy improvements.

1. UK: Universal Credit (UC) – Integrating Welfare Programs

The UK consolidated unemployment benefits, the EITC, housing benefits, and other welfare programs into Universal Credit (UC).

📌 Key Features:

- Designed so income increases lead to gradual benefit reductions, preserving work incentives

- A single application system simplifies welfare access and reduces administrative costs

- Benefit adjustments based on working hours to promote labor market participation

2. US: Earned Income Tax Credit (EITC) – Strengthening Work Incentives

The US EITC is a leading tax benefit encouraging labor market participation among low-income workers.

📌 Key Features:

- Provides a progressive refund structure to incentivize earning growth

- Additional benefits for families with children, ensuring economic stability

- Tax refund system allows workers to experience tangible financial support

3. Germany: Hartz IV – Balancing Unemployment Benefits and Work Incentives

Germany's Hartz IV integrates unemployment benefits and employment support, helping long-term unemployed individuals reenter the workforce.

📌 Key Features:

- Unemployment benefits gradually decrease if reemployment does not occur within a set period

- Comprehensive vocational training and reemployment programs

- Income surpassing a certain threshold results in gradual reductions in welfare benefits

4. France: RSA (Revenu de Solidarité Active) – Combining Work and Welfare

France’s RSA supports low-income workers by integrating employment earnings and welfare benefits.

📌 Key Features:

- Welfare benefits persist even when earnings rise, ensuring job stability

- Gradual reduction in welfare based on income growth

- Public sector and social enterprise initiatives provide job opportunities

5. Sweden: Active Labor Market Policies (ALMP) – Encouraging Workforce Participation

Sweden’s ALMP facilitates economic participation among unemployed and low-income individuals.

📌 Key Features:

- Mandatory vocational training for unemployed benefit recipients

- Government-driven job creation programs

- Temporary retention of benefits even as income rises, ensuring stable employment

📌 Lessons for Korea:

- Gradual benefit reductions to maintain work incentives

- Expanding vocational training to support workforce reintegration

- Aligning welfare programs to optimize employment participation

3. Evaluating Korea’s Social Security Policies

Korea’s social security system struggles to effectively encourage the working poor to reenter the labor market. To verify this, the study evaluates marginal tax rates and disposable income levels across different household types.

✔ Marginal Tax Rate Analysis

Marginal tax rates indicate the additional tax burden and benefit reductions when income increases.

- Benefits drop drastically beyond certain thresholds, discouraging work incentives

- Low-income workers may find it hard to leave welfare dependency and transition into full employment

✔ Disposable Income Analysis

Disposable income refers to actual earnings after taxes and benefit adjustments.

- Benefit recipients initially have high disposable incomes, but as employment earnings rise, total income can paradoxically decrease

📌 Conclusion – Current social security policies do not sufficiently encourage low-income workers to improve their earnings. Structural reforms are needed to promote labor market participation.

4. Policy Recommendations for Social Security Reform

The report suggests policy adjustments to enhance work incentives and support workforce reintegration.

✔ Reforming EITC to Align with Basic Living Allowances

- Expanding EITC eligibility to prevent drastic benefit reductions when employment income rises

✔ Increasing Earned Income Deduction for Basic Living Allowances

- Raising the deduction rate from 30% to 50% to promote gradual income growth

✔ Eliminating Overlapping EITC and Basic Living Allowance Benefits

- Clarifying EITC’s role in work incentives and basic living allowances’ role in economic security

These reforms can encourage the working poor to participate in the labor market and achieve long-term financial independence.

5. Additional Policy Considerations

✔ Encouraging Workforce Participation Among NEET Youth

- Offering tailored incentives to support long-term unemployed youth

- Learning from France and Sweden’s vocational programs

✔ Introducing Employment-Based Incentives

- Prioritizing stable employment over temporary positions

✔ Shifting Welfare Support from Household-Based to Individual-Based Systems

- Focusing on workforce reintegration for capable individuals

These measures can strengthen labor market participation and social mobility for low-income individuals.

Conclusion

This report examined social security policies and their impact on labor market participation. While overlapping welfare benefits may temporarily assist low-income groups, long-term solutions should focus on guiding individuals back into employment, benefiting both society and the individual. Policy discussions should balance practical concerns with theoretical insights to develop sustainable solutions for a fairer and more effective welfare system.

댓글

댓글 쓰기